Find out more in our guide to Bacs.Lloyds Bank customers are unable to access their money after the bank's online and mobile service crashed.Īccording to Downdetector, problems with Lloyds online and mobile banking began at 10am.

CHAPS vs Bacsīacs is another type of bank transfer, but unlike CHAPS and Faster Payments (which are instant or on the same day), Bacs can take up to three days to clear. Starling’s CHAPS fee is £20 per transaction. Most banks do charge a fee for sending CHAPS payments. There is no upper (or lower) limit on CHAPS payments, but for Starling customers, any payment over £500,000 will need to be sent with CHAPS. The CHAPS payment system is open on weekdays between 6am and 6pm for bank-to-bank transfers, but keep in mind that your bank might have its own cut-off time.Īs a Starling customer, you should contact customer service on working days between 9am and 3pm for CHAPS payments to be sent on the same day. That is, if the payment is made before the CHAPS cut-off time. In most cases, CHAPS payments arrive on the same day.

Santander UK plc (part of the Banco Santander Group).Royal Bank of Scotland plc (part of the NatWest Group).National Westminster Bank plc (part of the NatWest Group).Lloyds Bank plc (part of the Lloyds Banking Group).HSBC UK Bank plc (part of the HSBC Group).Handelsbanken plc (a UK subsidiary of Svenska Handelsbanken AB).Euroclear Bank SA/NV (Brussels Head Office).Elavon Financial Services DAC (UK branch).Danske Bank (a trading name of Northern Bank Limited, part of the Danske Bank Group).Clydesdale (a trading name of Clydesdale Bank plc, part of the Virgin Money UK PLC Group).CLS Bank International (an Edge Act Bank based in New York).Barclays UK (a trading name of Barclays Bank UK plc, part of the Barclays Group).Barclays International (a trading name of Barclays Bank plc, part of the Barclays Group).Bank of Scotland plc (part of the Lloyds Banking Group).Bank of New York Mellon (London branch).

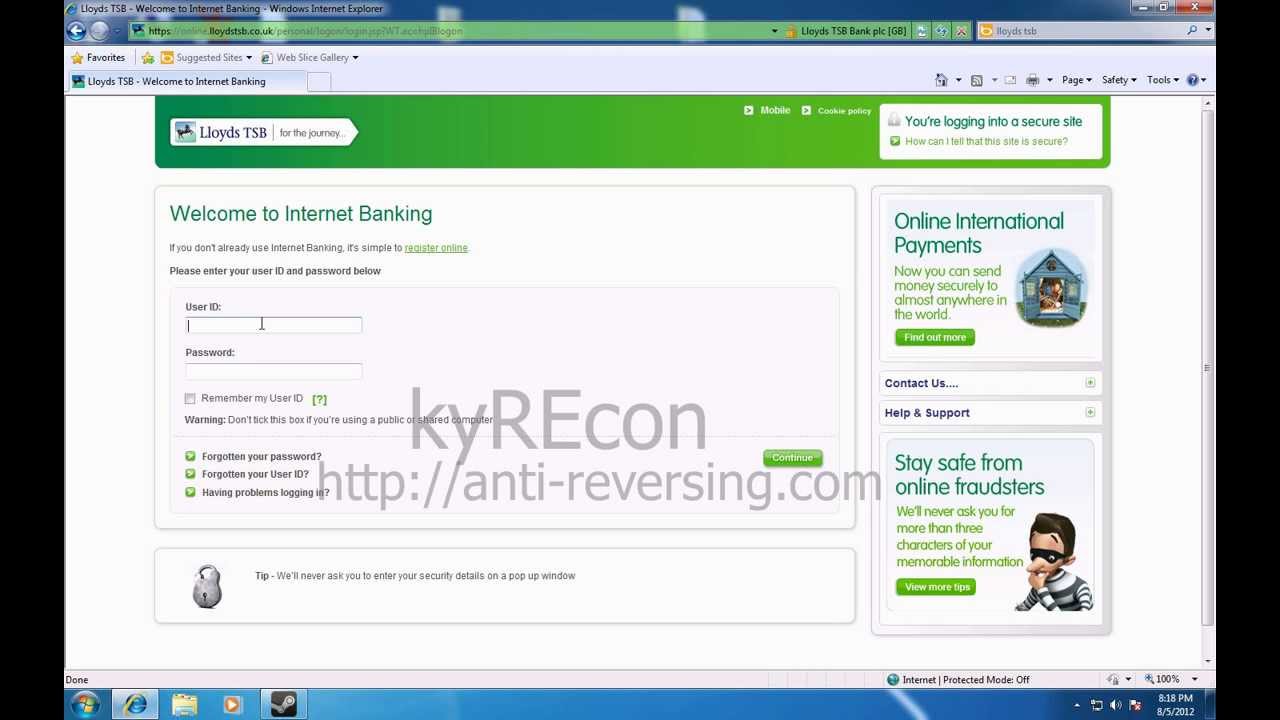

Llloyds tsb online banking code#

Just enter your bank’s sort code to find out.Īccording to the Bank of England, these are the direct participants of CHAPS: Our sort code checker will tell you if your bank accepts CHAPS payments. Many use third-party sponsors or intermediaries to process the CHAPS payments for them. Most UK banks are able to send and receive CHAPS payments, but not all are ‘direct participants’ of the CHAPS system.Ī bank doesn’t have to be a direct participant of the system to send and receive CHAPS payments. Read more about making CHAPS payments with Starling. If you’re a Starling customer and want to make a CHAPS payment (any transfer above £500,000), please get in touch with our customer service. Just remember to have all the payment and payee details ready. Depending on your bank, you can set up a CHAPS payment by visiting your branch and some banks might let you do this online. How does CHAPS work?ĬHAPS payments are a type of bank transfer and the payment methods are similar. What does CHAPS mean?ĬHAPS stands for Clearing House Automated Payment System.ĬHAPS was established in 1984 by the Bankers Clearing House in London, but throughout its history, the CHAPS system has been operated by many different companies, until the Bank of England overtook this responsibility in 2017. According to the Bank of England, the average daily value of CHAPS payments in February 2021 was £341 billion.ĬHAPS can only be used to settle sterling transactions within the UK and the system is managed by the Bank of England. A lot of money flows through the CHAPS system. A CHAPS payment is like a regular bank transfer (where funds move between two accounts) but CHAPS is often characterised by being high-value payments.

0 kommentar(er)

0 kommentar(er)